Must know these before you consider to buy EC

For me, Executive Condominium (EC, 中文名:新执行共管公寓) units are an advanced version of HDB. ECs are launched by private property developers, and all buyers may contact them directly if they wish to buy one. All HDB rules and conditions would apply. As such, it is subject to the same restrictions like a Minimum Occupancy Period (MOP) of five years, and restrictions on who can buy it.

An EC is considered HDB property for first 5 years. It can be sold to Singaporean and PRs from 6th year and onwards. EC is fully privatised in the 10th year. From the 11th year onward, it can be sold like any other private property, and foreigners, companies, or others can also buy it.

An EC is different from a Built-to-Order (BTO) flat, in that it’s built by private developers. An EC is a full suite condo. It comes with the swimming pool(s), gym, barbeque pits, and other necessary facilities you would expect of a private development.

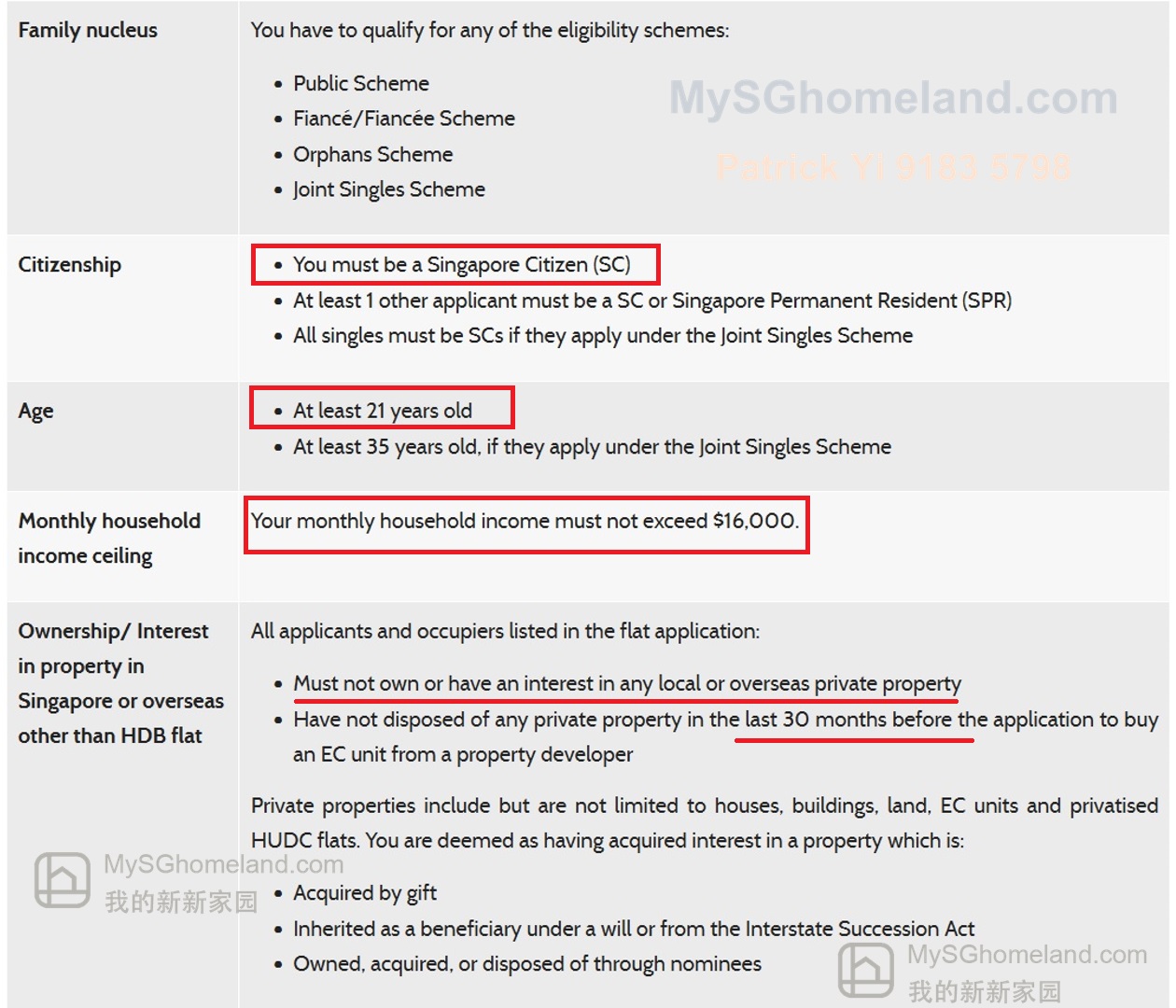

Eligibility

You must meet the eligibility conditions to buy an Executive Condominium (EC) unit from a property developer. Please also find out if you must pay a resale levy and what conditions will apply after you buy an EC unit, before you apply for an EC unit.

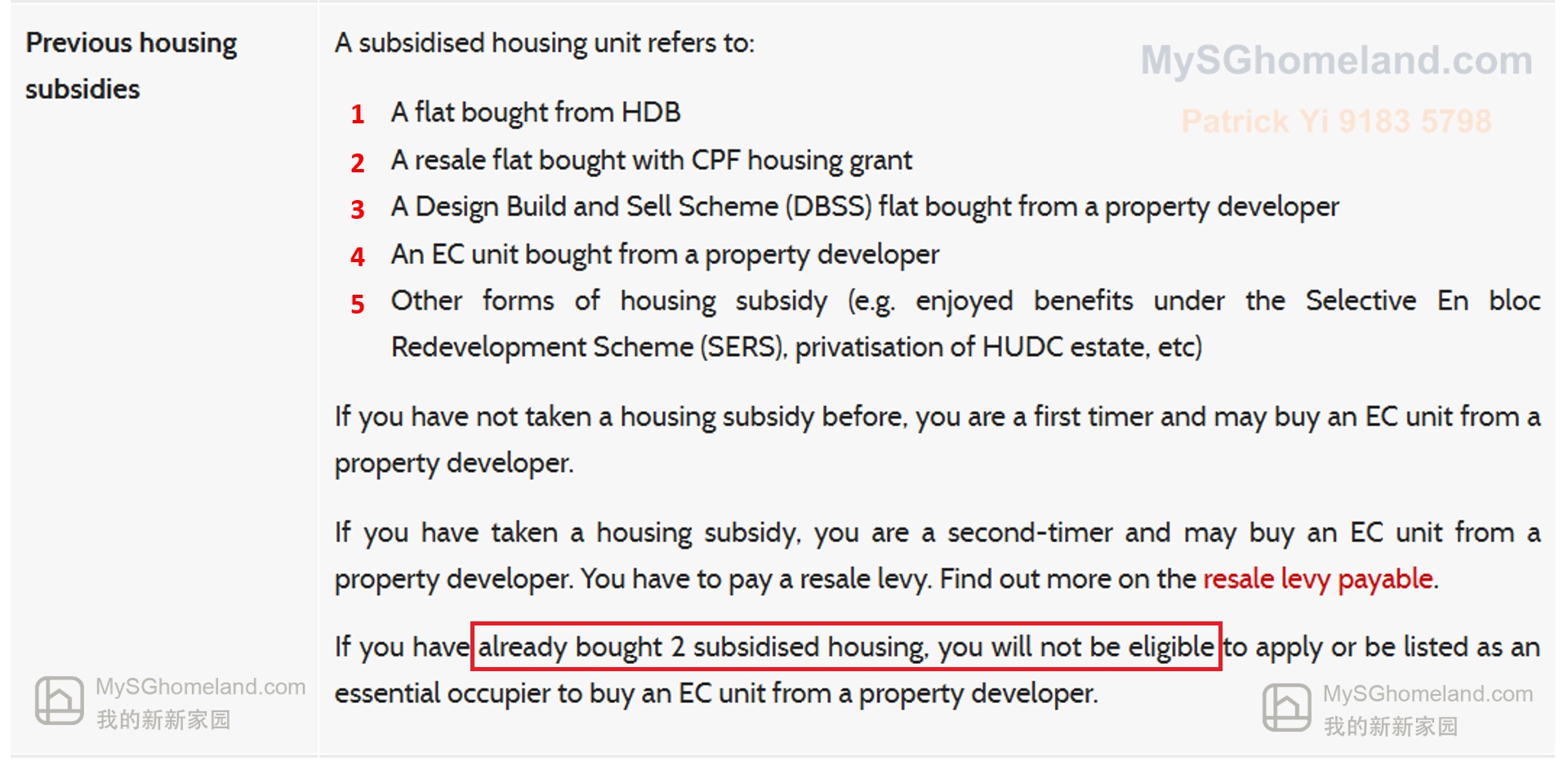

1st Timer vs 2nd Timer

As we all know, 1st timers also have much higher rate to secure a unit when they apply.

You can remember this:

- First Timer eligible up to S$30K CPF Housing Grant;

- Second Timer achnowledge to pay resale levy.

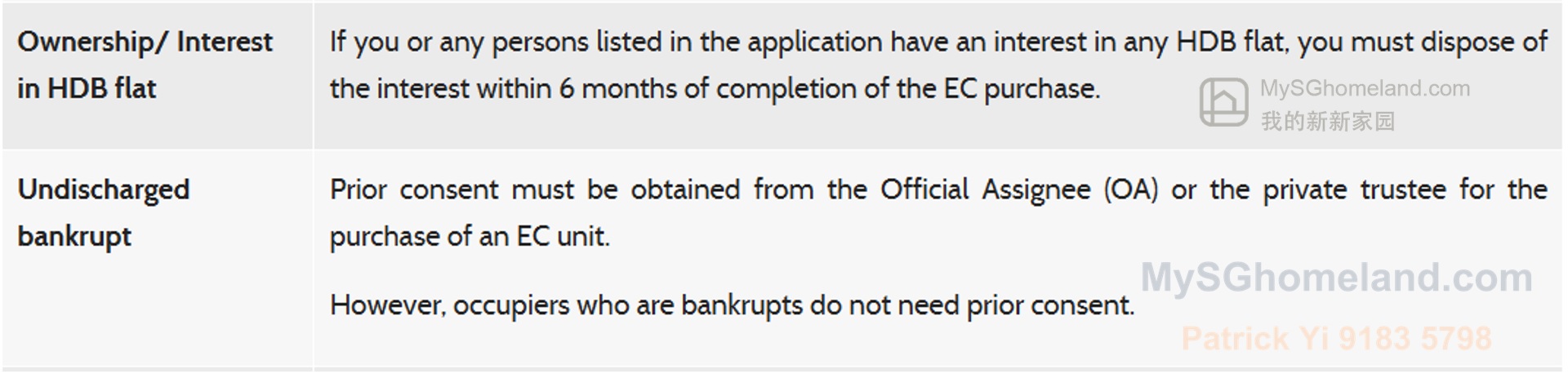

Ownership/ Interest in HDB flat

If you or any persons listed in the application have an interest in any HDB flat, you must dispose of the interest within 6 months of completion of the EC purchase.

Wait-out period for applying EC

Cancellation of application after booking a flat

If you booked a flat and subsequently cancel your booking, you must wait out a 1-year period from the date of the cancellation before you may apply or be listed as an essential occupier to buy an EC unit from a property developer.

Terminated the Sale and Purchase Agreement for an EC/ DBSS flat

If you had previously bought an EC unit/ DBSS flat from a property developer and subsequently terminated the Sale and Purchase Agreement, you must wait out a 5-year period from the date of the termination before you may apply or be listed as an essential occupier to buy an EC unit from a property developer.

Documents Required

When you book an EC unit with the developer, you must bring along the following documents of all the persons listed in your EC application:

Identity documents

- Identity cards of all listed applicants/ occupants

If you are employed, or serving National Service under the Singapore Armed Forces/ Civil Defence/ Police Force, you will have to log in to the Singpass app to facilitate verification of your digital IC

- Passport for non-citizens

- Birth certificate(s) of your child(ren)

Verification of relationship

- Marriage certificate, if you are married; or divorce certificate, if you are divorced

- Death certificate of spouse, if spouse is deceased

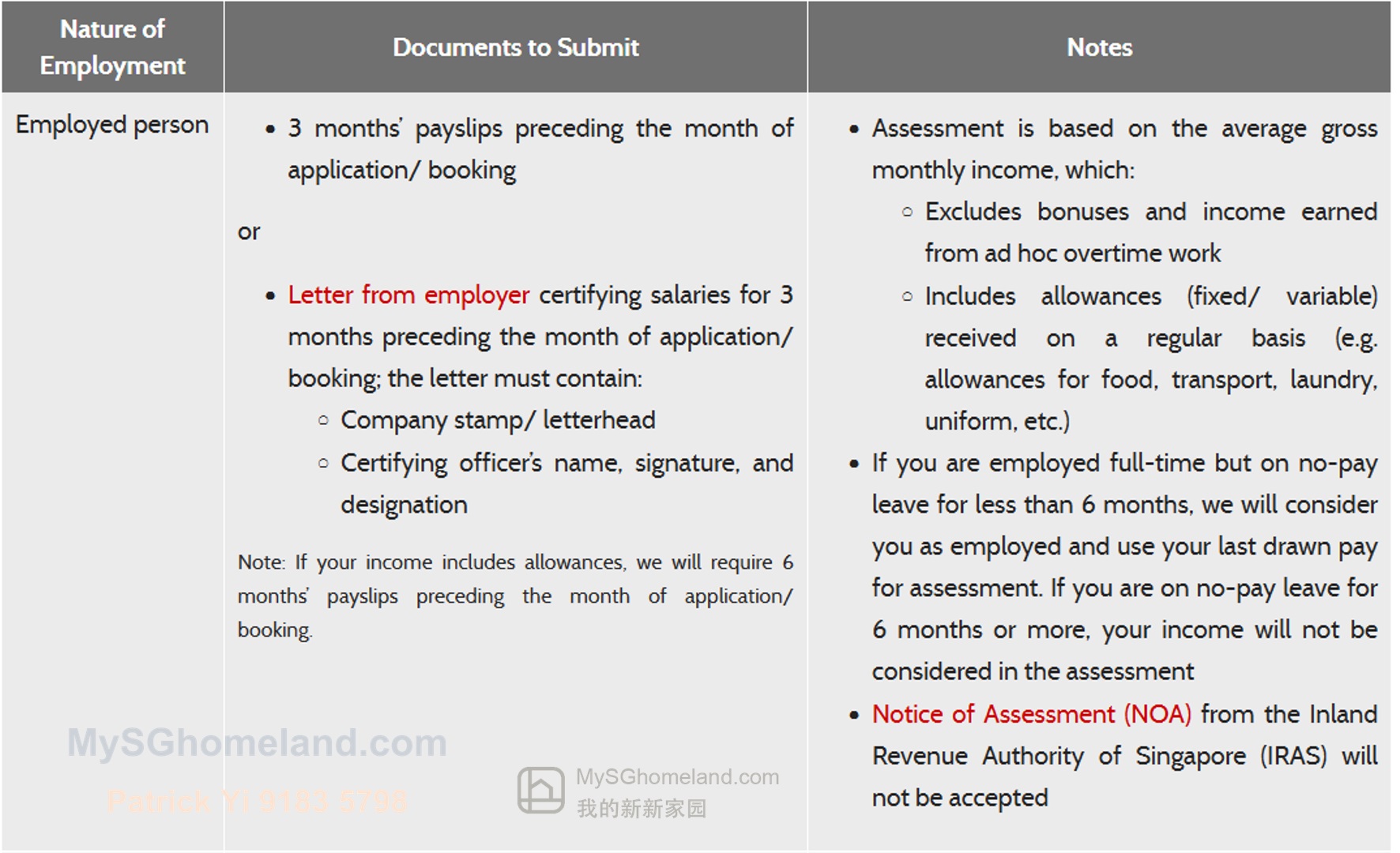

Income documents

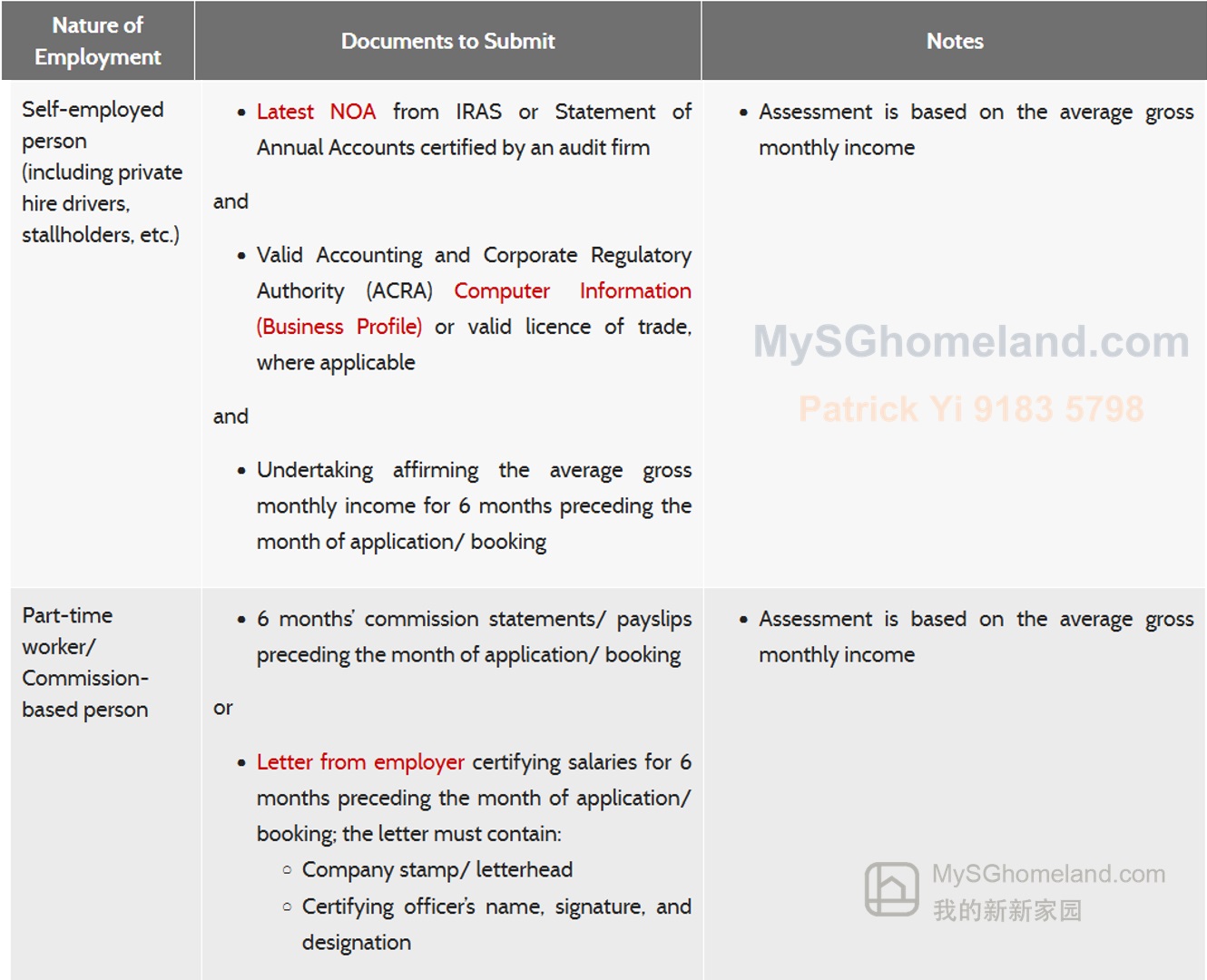

Prepare the required documents based on the nature of employment as listed below. The developer may also request other documents for verification, if needed.

if you are Employed person:

if you are Self-employed person (including private hire drivers, stallholders, etc.) and/ or Part-time worker/ Commission-based person:

if you are Odd job worker (including freelancers, etc.) and/ or Unemployed person (from 18 to 62 years old):

Income/ allowance that will be considered for income assessment

- Allowances (fixed/ variable) received on a regular basis, e.g. allowances for food, transport, laundry, uniform, etc.

- Sustenance allowance

- Stipend received on a regular basis for work conducted for the educational institute, during the full-time studies

Income/ allowance that will not be considered for income assessment

- Alimony allowance

- Bonuses

- Director's fee

- Income from ad hoc overtime work

- Interest from deposit accounts

- National Service Allowance

- Rental income

- Scholarship overseas allowance

- Overseas cost of living allowance

- Pension

Resale Levy

If you have bought a subsidised housing, you will need to pay a resale levy when you buy a second subsidised flat. A subsidised housing is:

- A flat bought from HDB

- A resale flat bought with CPF housing grant

- A Design Build and Sell Scheme (DBSS) flat bought from a property developer

- An Executive Condominium (EC) unit bought from a property developer

- Other forms of housing subsidy (e.g. enjoyed benefits under the Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate etc.)

If you do not intend to buy a second subsidised flat from HDB, i.e., you are buying a resale flat or private residential property, you need not pay the resale levy.

Subsidised flat sold on or after 3 March 2006

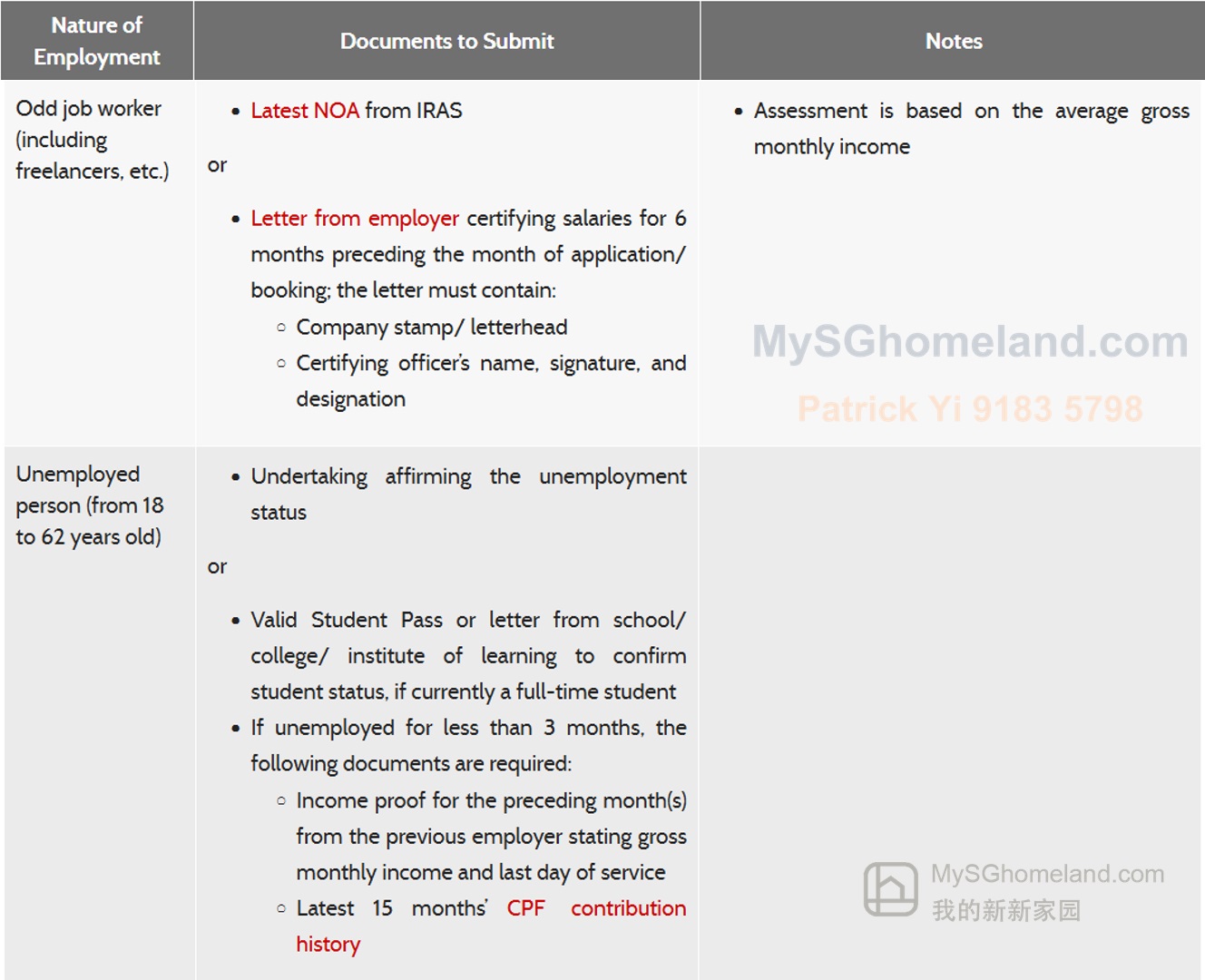

If you have sold your first subsidised flat from 3 March 2006 onwards, you will pay a fixed amount resale levy as follows:

Payment of resale levy

The resale levy payable is determined at the point you book your second subsidised flat. It applies regardless of ownership type (joint-tenancy or tenancy-in-common) or shared interest in the flat. Payment must be made using your flat sale proceeds and/or cash. HDB housing loan will not be extended to the payment of a resale levy.

Buying Procedures

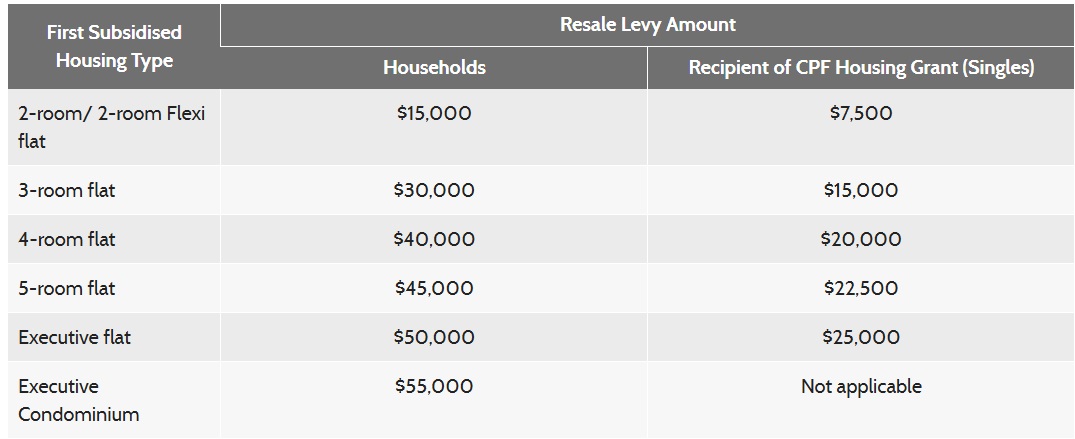

Now you should get some ideas about the buying process for an Executive Condominium (EC) unit from a property developer.

Step 1: EC sales launch --- No payments at this stage

The property developer will announce the project launch in the newspapers, social media, their website, etc. You may contact the property developer to find more information on:

- Preliminary designs

- The number of EC units offered

- Indicative prices

Before you make an application for an EC, check if you are:

- Eligible to buy an EC unit from a property developer

- Able to obtain a housing loan from a financial institution

- Able to pay the option fee, downpayment, and other costs related to the purchase such as:

- Legal fees

- Resale levy

- Renovation cost

Step 2: Submit application

You must submit an application to the property developer. Property developer has the choice to offer the units via computer balloting or walk-in selection. Developer would forward it to the HDB for final approval.

Step 3: Receive outcome of application --- No payments at this stage

Property developer will inform you of the outcome.

Step 4: Book EC unit

- 5% option fee by Cashier’s Order, cheque or telegraphic transfer/ Fast and Secure Transfers/ MAS Electronic Payment System

- Please bring along documents.

Property developer will invite you to book an EC unit and grant you the Option to Purchase (OTP), if you are eligible to buy an EC unit.

For applicants applying for CPF Housing Grant

Submit the completed EC application form, the application form for CPF Housing Grant for EC, and all other required supporting documents directly to the property developer.

After booking an EC unit, you must submit the completed application form to use your CPF savings to the CPF Board for processing. This is so that you can use your CPF savings or the CPF Housing Grant, or both, for the payment of your EC unit.

Prompt submission will ensure that you will be able to use the CPF funds to pay for the balance downpayment.

Step 5: Sign Sale and Purchase Agreement

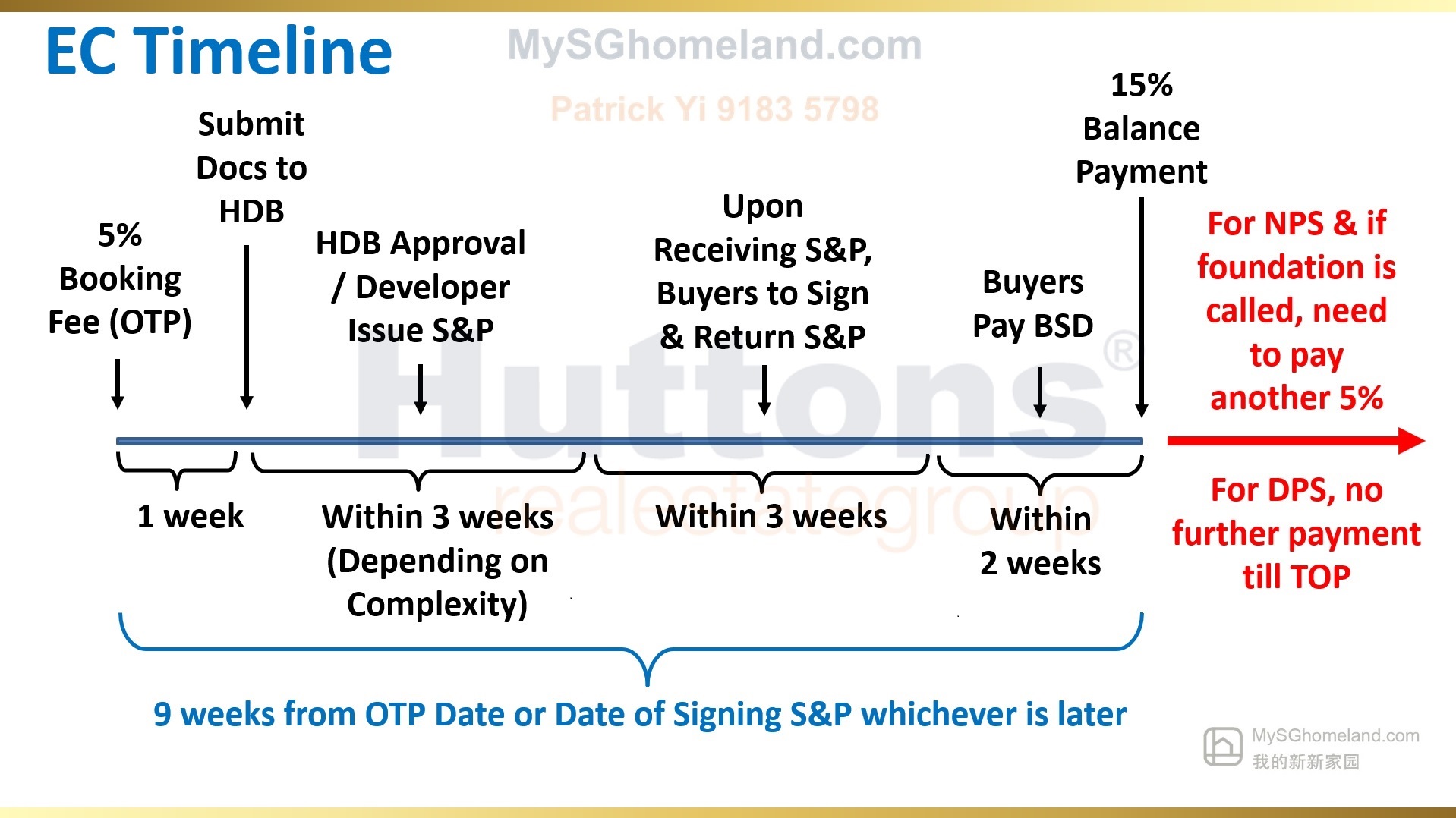

- 15% of the purchase price plus 1-3% legal and stamp fees by CPF OA savings or cash within 9 weeks from the date of OTP or signing of the Sale and Purchase Agreement.

- For applicants who are eligible for the CPF Housing Grant, the grant forms part of your CPF funds and can be used to pay the balance downpayment.

Property developer will invite you to sign the Sale and Purchase Agreement.

You are advised to engage a solicitor to handle the conveyancing matters, arrange with a financial institution for financing, and check with CPF Board on the use of your CPF savings to pay for the EC unit.

Step 6: Collect keys to EC unit

Property developer will invite you to collect the keys when the EC project is completed. But it needs normally 3 to 5 years.

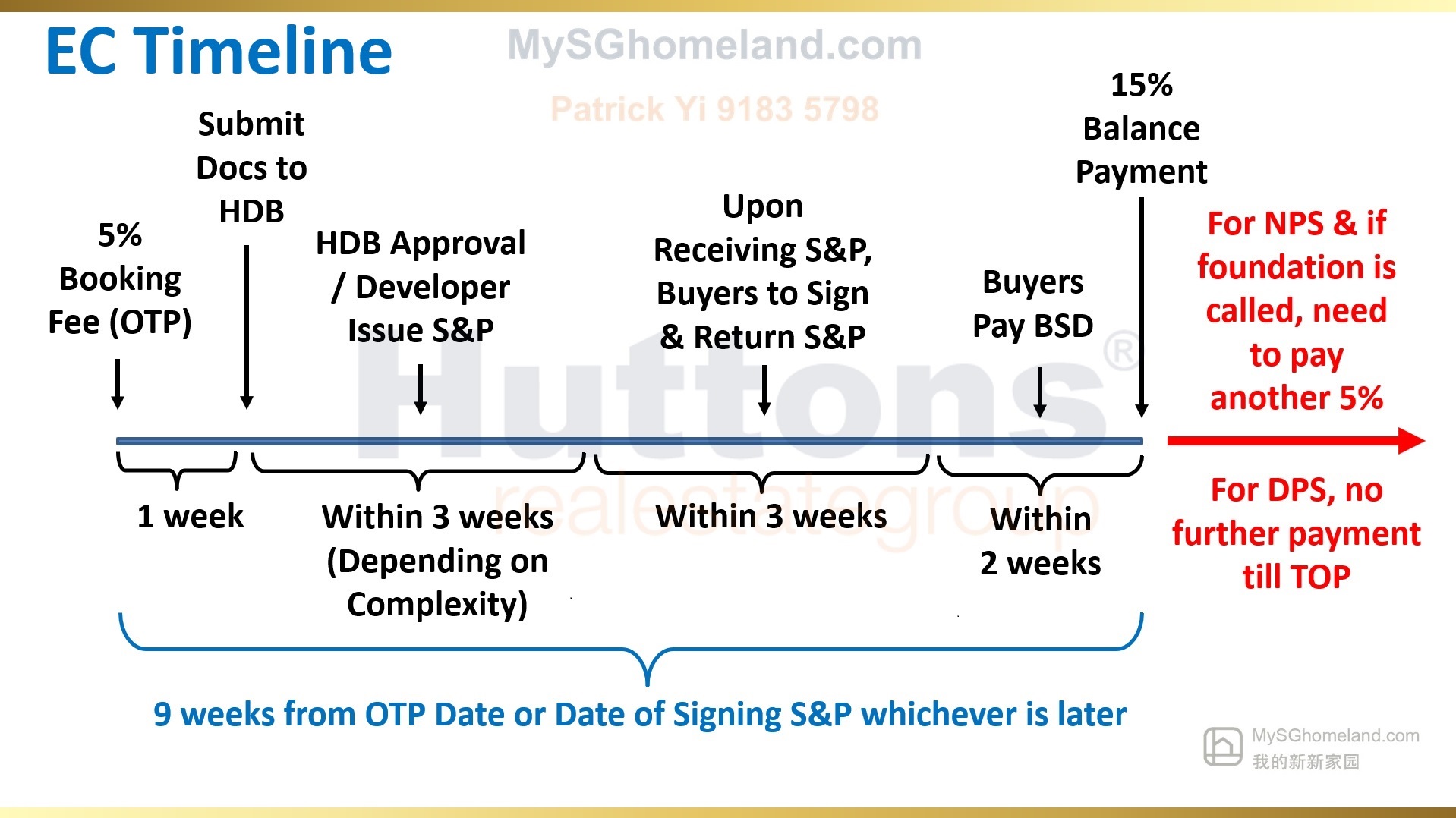

in short, you can ref to this chart for better understanding:

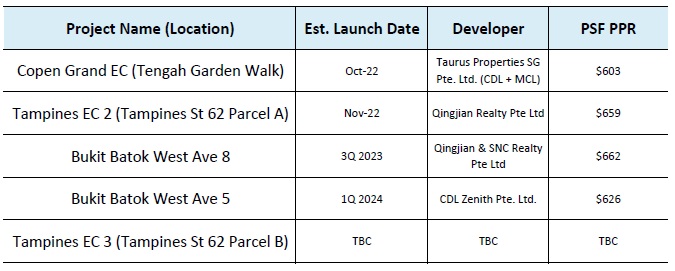

Sales launches

Check out the list of EC projects and their Temporary Occupation Permit dates below, and lookout for the upcoming EC project launches:

- Available EC projects

- Upcoming EC development

- List of EC Temporary Occupation Permit (TOP) dates

Please check the eligibility conditions for buying an EC unit. You have to engage a solicitor to act for you in the conveyancing matters. Do also arrange with a financial institution for a housing loan if you need one, and check with CPF Board on the use of your CPF Ordinary Account savings to pay for the EC unit.

Sale of EC units on the open market

EC owners may put up their unit for sale on the open market once they have met the minimum occupation period (MOP) from the date of Temporary Occupation Permit (TOP).

If you are looking to buy an EC unit on the open market that have met the MOP, please check if you meet the following eligibility conditions. Please note that these are considered private properties and the resale transaction will be completed by your solicitors at their office.

Purchase of resale EC units is not eligible for any CPF housing grants. Second-timers are not required to pay a resale levy when buying an EC unit that have met the MOP on the open market.

Besidies these, please be informed that there is no monthly household income ceiling.

As resale EC units are private residential property:

- If you own an existing HDB flat, please check that you have met the MOP for your flat before buying a resale EC unit. You have to continue living in the HDB flat unless you have obtained HDB’s prior approval to rent* it out

* There are eligibility conditions that you and your tenants have to meet

- SPR households must dispose of their HDB flats within 6 months of buying a resale EC unit

- There is no requirement to dispose of your existing private properties after buying a resale EC unit

Conditions After Buying (For EC)

There are conditions that apply after you buy an EC unit from a property developer.

Disposal of existing HDB flat

You and your family members listed in the EC application must dispose of any existing flat within 6 months of taking possession of the EC unit.

Minimum occupation period (MOP)

Sale of EC

EC units can only be sold on the open market after the 5-year MOP, computed from the date of the Temporary Occupation Permit, has been met.

Essential occupiers in EC

Occupiers who are essential in forming a family nucleus with you in the EC application must continue to be listed in the application, and live in the EC unit during the 5-year MOP. They cannot apply or be listed as occupiers in another application to buy an HDB flat or another EC unit within the 5 year from your taking possession of the EC unit.

Taking a housing subsidy

You and your spouse have taken a housing subsidy when you buy an EC unit from a property developer.

Citizen Top-Up

If you are from a Singapore Citizen (SC)/ Singapore Permanent Resident (SPR) household, you may apply for a Citizen Top-Up Grant of $10,000 when your SPR family member obtains Singapore citizenship or when you have an SC child. Read more on the Citizen Top-Up.

but be informed that it is only distributed to:

- The original SC applicant/ owner, or

- The SC spouse who was previously an SPR (if listed as an owner)

You must submit your application within 6 months of being eligible for the Citizen Top-Up.

If any enquiries, you can check with HDB directly for more accurate answers.

Renting out your EC

- Renting out the whole EC unit

Renting out the whole EC unit within the 5-year MOP is not allowed. Do remember it is considered as an HDB unit within first 5 years.

- Renting out rooms

You do not need prior approval from HDB to rent out the bedrooms in your EC within the MOP. However, you must register the renting out of bedrooms with HDB within 7 days of doing so. You are also required to notify HDB when you renew or terminate the renting out of bedrooms, and when there are changes to your tenants’ particulars.

Interest in private property

You may invest in private residential property after the 5-year MOP.

Buying another subsidised home

After selling your EC unit in the open market, you must wait 30 months before you may apply to buy:

- A flat from HDB

- A resale flat with CPF Housing Grant (excluding the Proximity Housing Grant)

- Another EC unit from a property developer

Resale levy

The resale levy is meant to reduce the housing subsidy on the buyers' second subsidised flat or EC unit from a property developer. It ensures a fairer allocation of housing subsidies among home buyers.

You are liable to pay a resale levy of $55,000:

- When you sell an EC unit (bought with the CPF housing grant; or bought from a project launched from 2015 onwards) after meeting the MOP, and, after meeting a 30-month waiting period, buy a second subsidised flat from HDB or take over ownership of another subsidised HDB flat

- Buy an EC unit from a property developer

If you do not intend to buy a second subsidised flat from HDB or EC unit from a property developer, and choose to buy a resale flat, or a private residential property, you need not pay the resale levy.

Timeline to apply/ buy an EC unit

So now you could get a clear picture on the EC. You must meet the eligibility conditions to buy an Executive Condominium (EC) unit from a property developer. You must pay a resale levy and what conditions will apply after you buy an EC unit, before you apply for an EC unit.

Now we come to the financial part. 5% booking in CASH is a must. But basically first 20% payment for the booking and deposit paid within 9 weeks from the OTP date/ Signing date of S&P (see whichever is later).

CPF Housing Grants

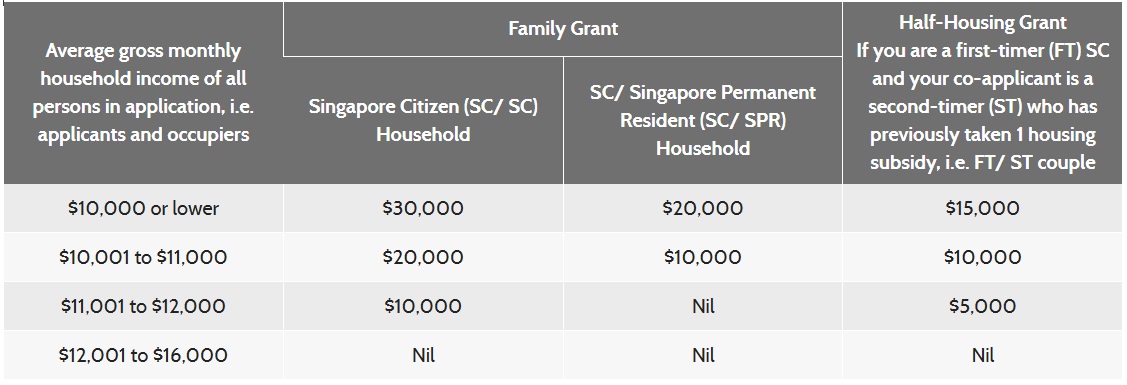

The CPF Housing Grant available for buying an Executive Condominium (EC) unit from a property developer is:

- Family Grant; or

- Half-Housing Grant

You and any co-applicants must be eligible for the grant at the point of booking the EC unit.

Based on the introduction shown as above, you would be easy to identify if you can receive any housing subsidy from HDB or cannot get it.

You may apply for the CPF housing grant when booking your EC unit with a property developer. CPF housing grant is fully credited into the CPF Ordinary Accounts of eligible SC applicants. It is not paid in cash.

CPF Housing Grant Usage

The CPF housing grant can be used to:

- Offset the balance downpayment for the EC unit and subsequent payments towards the purchase price

- Reduce the mortgage loan for the EC unit

If you are buying an EC unit with a housing loan from a financial institution, the grant will be included in the computation of withdrawal of CPF savings (up to the applicable limits). The grant cannot be used for the minimum cash downpayment (if any) and monthly mortgage instalment payments.

Say, Mr O (SC) and Mrs O (SPR) have booked an EC unit. Both are first-timers and their monthly household income at the point of application is $10,500. A grant of $10,000 will be fully disbursed to Mr O, the SC applicant. Subsequently, if Mrs O obtains Singapore citizenship or the couple has an SC child, they may apply for the $10,000 Citizen Top-Up.

How can I buy an EC unit?

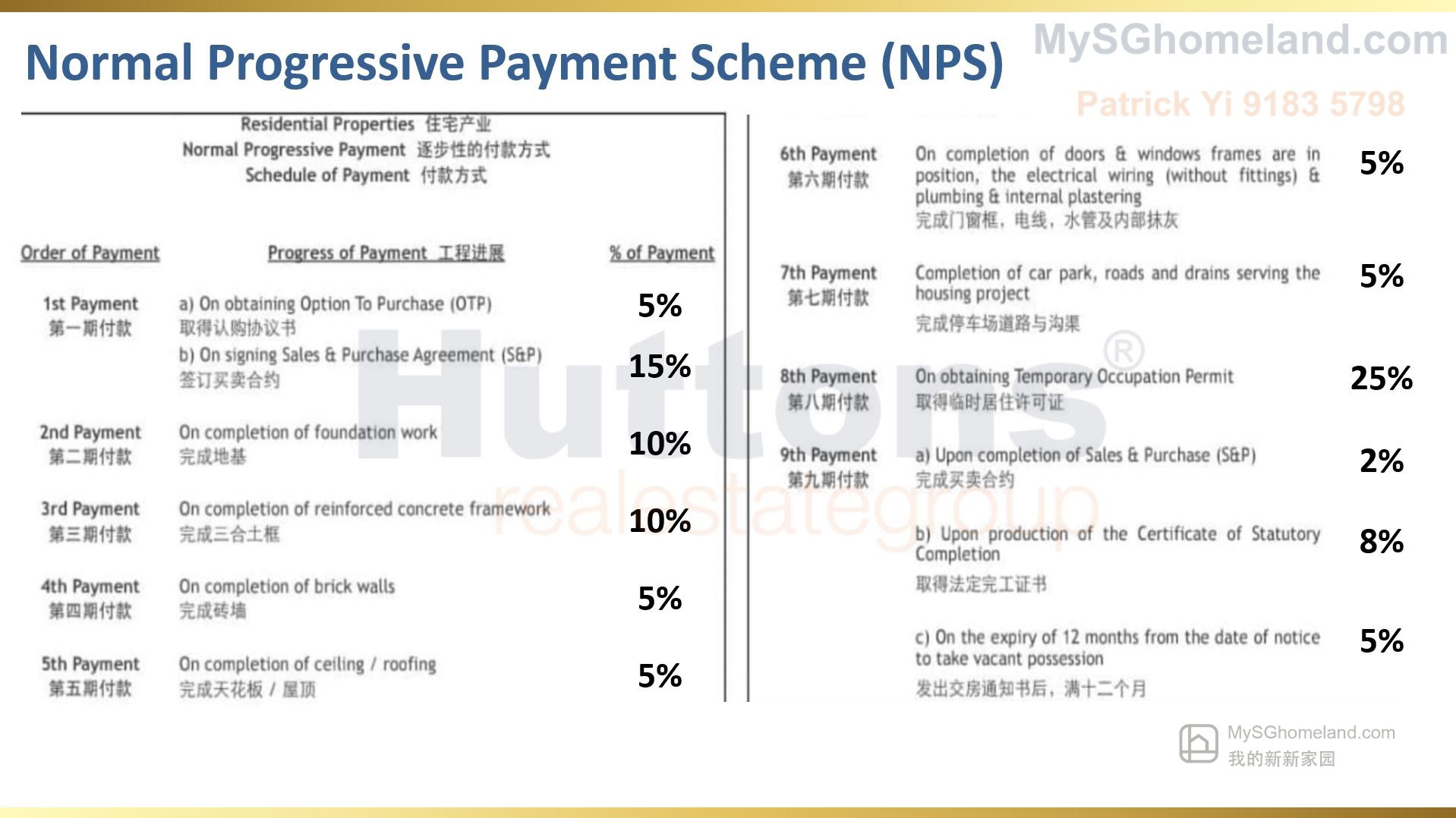

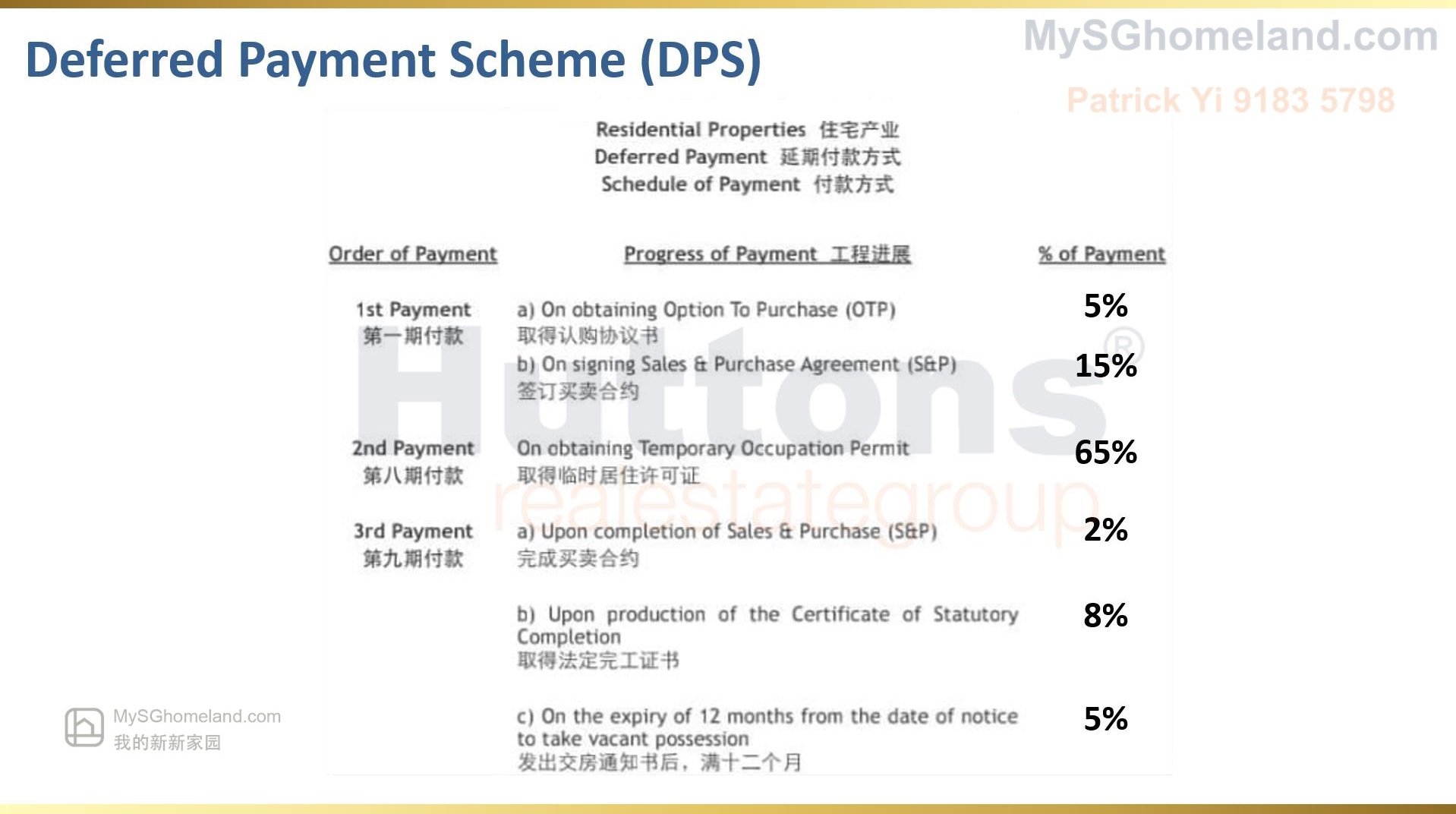

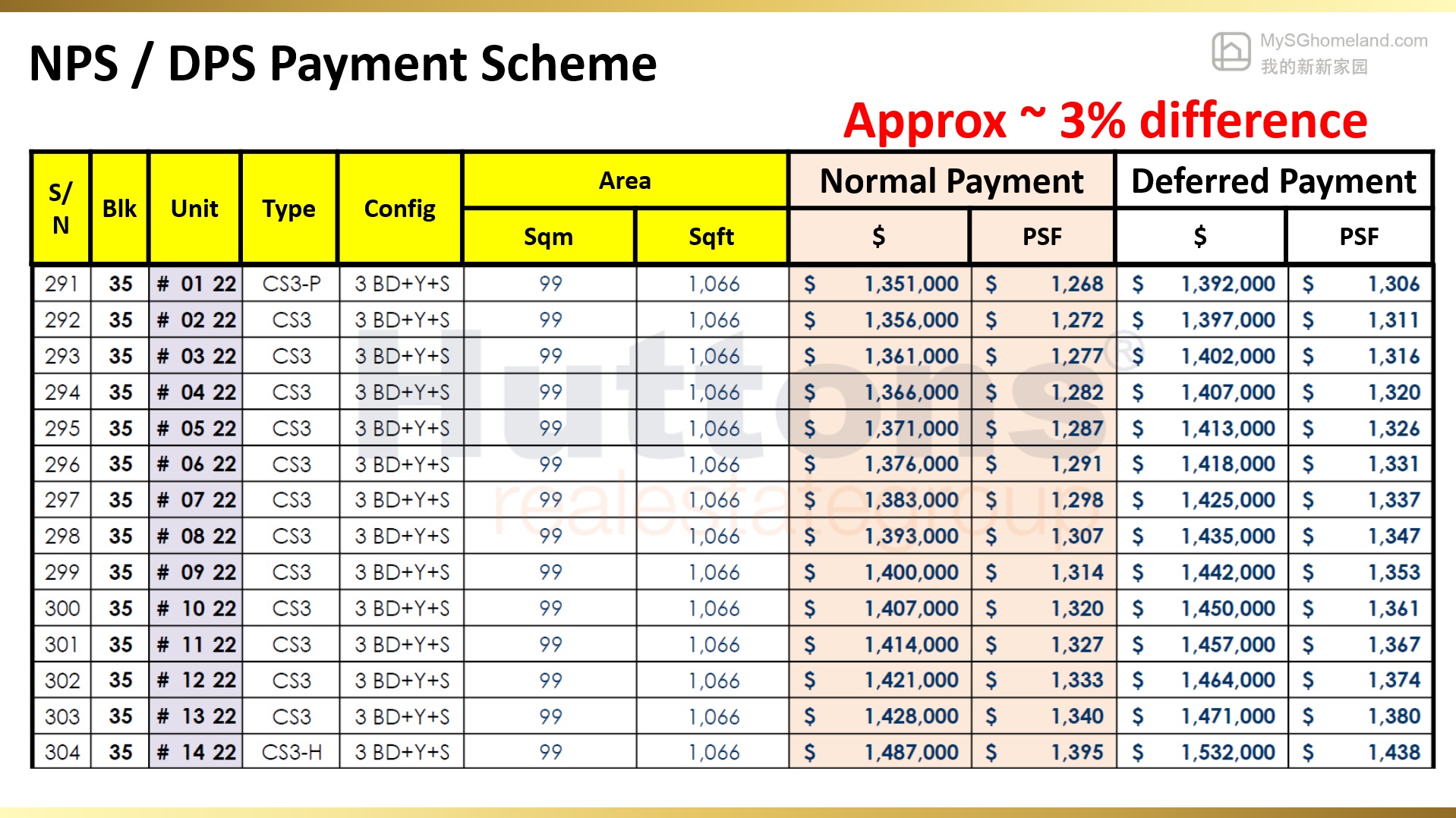

There are Normal Payment Scheme (NPS) and Deferred Payment Scheme (DPS). You must fulfil at least one of the Payment Scheme

Normal Payment Scheme (NPS) for the progressive payment schedule

Deferred Payment Scheme (DPS) for the progressive payment schedule. Suitable for young couple with financial issues but aimed for bigger units.

We use North Giaya to showcase two schemes for the price difference. The price for DPS is 3% normally higher than NPS one.

But you have enjoyed the flexibility when buyers cannot get any sponserships from their parents. This could become your finanical support to own a bigger unit.

Before you step into any EC showflats, you need to know our Upcoming ECs. Then you know which one is the best for you.

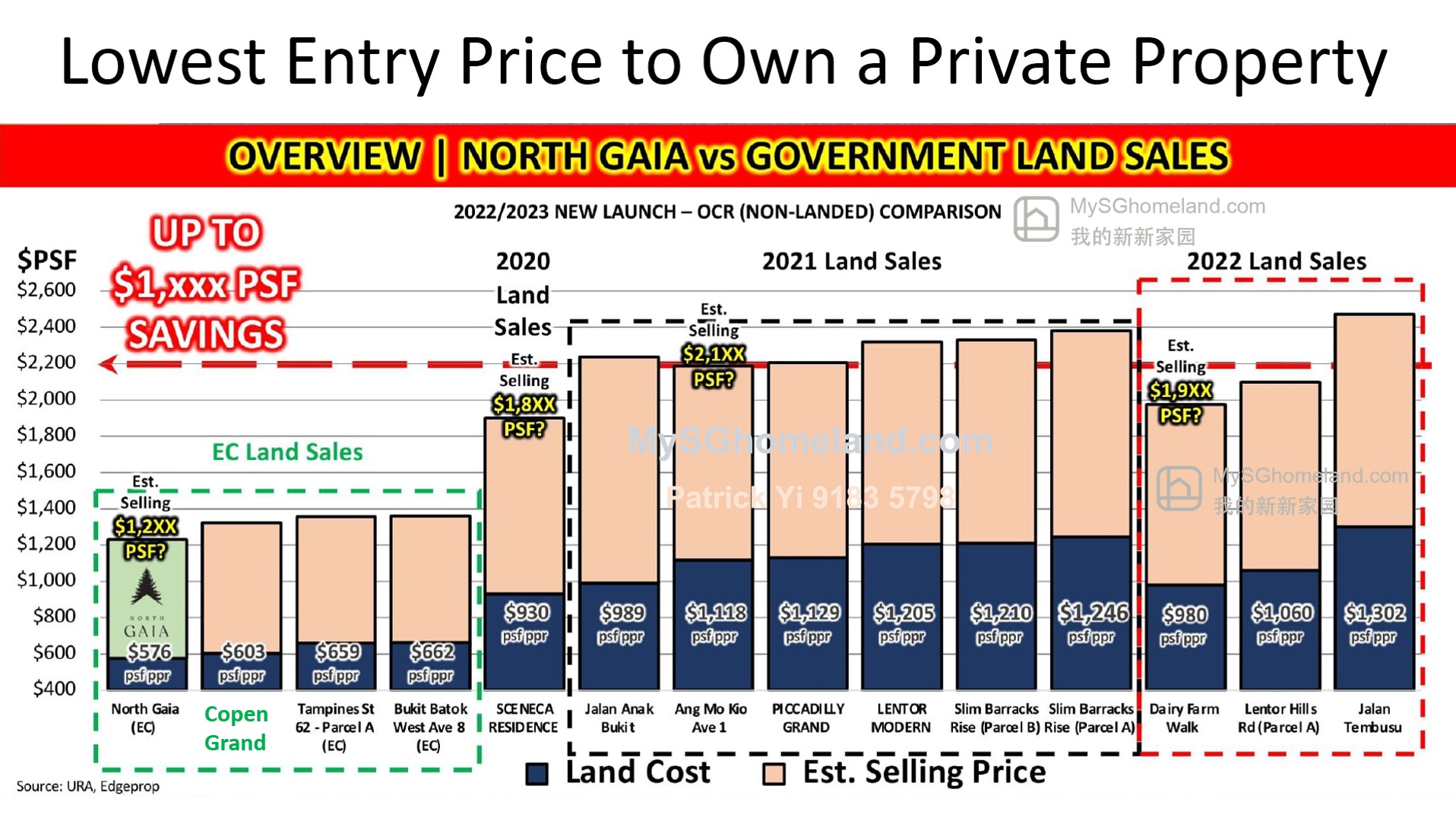

So, to summary why you must apply and buy an EC in one chart:

now you know ECs is perfect entry property for couples planning to multiply their asset in future, with very good capital upside. And dont forget that buying an EC is a privilege that only Singaporeans can enjoy based on certain eligibility criteria.

Make Appointments 预约, Whatsapp us to find out for more

Or book your timeslot to visit our latest EC: Copen Grand

To know more about Copen Grand, pls click here

book your timeslot to visit our latest EC: Copen Grand, pls click here.

All the best on your property hunting. We are waiting for your calls at any time.

了解我们的中文网页,请点击这里查看更多。